Countdown to Compliance: PCI DSS v4.0.1 Deadline Looms

The clock is ticking! The countdown has begun!

If you are wondering that December 2024 is long gone and we are late with the wishes and countdown, you are not wrong! We are already in February 2025, and while we certainly wish for this year to be a great one for all our readers, this is not your usual Happy New Year post. This countdown is about the PCI DSS v4.0.1 compliance deadline, and it’s one you don’t want to miss.

This is a reminder to all entities regarding the PCI DSS v4.0.1 future dated new requirements which were termed in the standard as ‘Best practice until March 2025’. These requirements shall become mandatory and effective for all starting from April 2025.

If you manage the PCI DSS Compliance Program for your entity, make sure to define processes and implement controls for these requirements by the end of March 2025 to maintain their ongoing PCI DSS compliance.

Organizations that delay implementation risk more than just non-compliance; they expose themselves to potential security incidents and data breaches that can result in substantial financial losses, damaged reputation, and eroded customer trust. The cost of reactive measures and potential breaches far exceeds the investment required for timely compliance preparation. Don’t let your organization fall into this preventable trap!

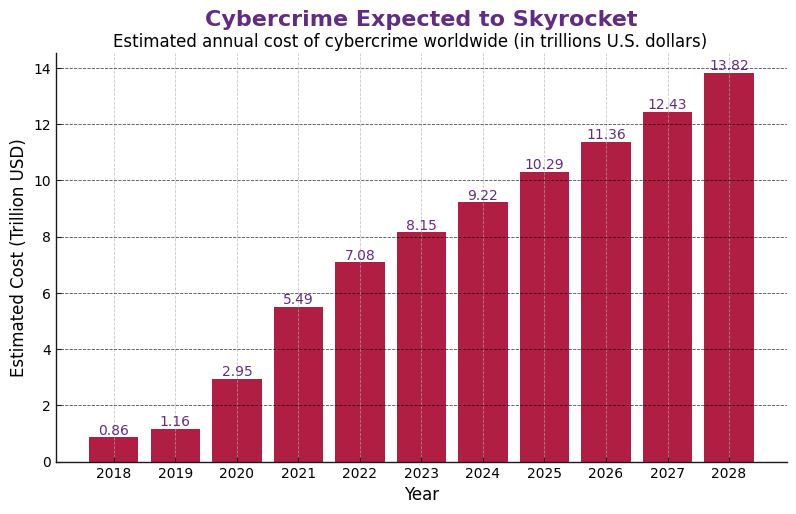

As per Statista, the estimated annual cost of cybercrime is expected to skyrocket to 10.29 trillion USD in 2025.

The new requirements reflect the evolving security landscape and are essential to safeguarding payment data and processes in a world of increasing cyber threats.

The question is: Are you and your entity ready for these changes in your PCI DSS compliance program?

This blog is here to help you understand why these requirements matter and how to prepare for these mandatory updates. Plus, we have got you covered with an additional detailed resource document containing the required activity descriptions along with the applicability of these PCI DSS control requirements, available for download separately.

Understanding and incorporating these new PCI DSS compliance requirements will be crucial for protecting payment data and strengthening your overall security posture as cyber threats become more complex.

Why PCI DSS Matters Now More Than Ever

The payment ecosystem is under constant threat from cybercriminals which results in an increased risk of security incidents and data breach. With technologies and attack vectors evolving, organizations handling cardholder data cannot afford to remain complacent. The future dated new requirements of PCI DSS v4.0.1 addresses these challenges by:

- Introducing more granular security requirements for modernized payment environments and technologies.

- Emphasizing continuous monitoring and enhanced documentation practices to combat threats effectively.

Whether you are a merchant or a service provider, these updates aim to enhance data security while maintaining the scalability of the compliance framework.

Key Challenges and Opportunities

While the updates strengthen the security posture of organizations, implementing them comes with its own set of challenges and opportunities. Some of them can be:

- Resource Allocation: Small and Medium Sized Businesses (SMBs) might find it difficult to dedicate resources to define, implement, and maintain these new requirements.

- Technical Expertise: Many requirements, such as those revolving around encryption, hashing, payment page integrity checks, logging and monitoring, demand a higher level of technical knowledge that the existing personnel may not be equipped with.

- Opportunities for Growth: Entities that adopt these changes early and effectively can build greater trust with customers and stand out as security-centric organizations.

Following our roadmap described in the next section along with the guidance provided in the additional detailed resource document, your entity can effectively address these challenges and reap the benefits of the opportunities.

How to Get Started?

With the compliance deadline less than two months away, it is time to act now. Here is a roadmap for your entity to stay on track:

Understand the future dated new requirements which are termed as best practice requirements until March 2025: Ensure that your team is well-versed with these specific PCI DSS v4.0.1 requirements.

Perform a Targeted Gap Analysis: Engage experts and identify the potential gaps with your existing processes and controls in the context of these requirements.

Define a Plan: Create a detailed implementation plan for addressing the identified gaps keeping in mind the deadline of March 31, 2025.

Revalidation: Get the newly developed or improved processes and controls validated against these requirements by experts to ensure ongoing compliance to PCI DSS standard.

The sooner you begin, the smoother your transition to PCI DSS v4.0.1 compliance will be. Taking support of security experts and QSAs from QSA companies can significantly make your job a lot easier.

Stay Ahead! Don’t Wait Until the Last Minute

If your entity has not defined processes and implemented controls for these requirements yet, it is now or never!

The deadline for complying with the future-dated new requirements of PCI DSS v4.0.1 is fast approaching and immediate action is now required. Every day of delay increases the risk of non-compliance, potential security incidents, data breaches, and financial penalties.

Remember, compliance isn’t merely about meeting regulatory requirements and avoiding penalties; it’s about building a robust security foundation that protects your environment and customers’ sensitive payment data in an ever-evolving threat landscape. Taking proactive steps now not only ensures seamless compliance but also demonstrates your commitment to maintaining the highest security standards.

The cost of reactive security measures and potential breaches can far outweigh the effort of proactive compliance readiness.

By ensuring compliance with these requirements before March 31, 2025, your organization will not only meet regulatory mandates but also strengthen customer trust, enhance data protection, and build long-term resilience against evolving cyber threats.

Compliance Support

If you need guidance on the future-dated new requirements of PCI DSS v4.0.1, our detailed resource document breaks down the intricacies by providing the control descriptions, activity details, and the applicability notes for the requirements which the entities must implement and adhere to by the end of March 2025 to maintain their ongoing PCI DSS compliance.

We have a team of security experts and QSAs who can assist and guide you throughout your PCI DSS compliance program.

Reach out to us for any consultation & implementation support that you may require.

Author

-

Shashvat is a Senior Cybersecurity Consultant in the GRC department and has an expertise in handling Information Security and Payment Security Compliance Programs for new and existing clients across Europe, USA, APAC, Europe, and Africa. He holds good exposure in performing PCI DSS gap assessments, ISO 27001 gap assessments, NIST CSF audits, Information Security internal audits, and in report writing.

View all posts